What to Know About Bank-Owned Farm Properties Across the U.S.

Exploring Bank-Owned Land Across Rural States

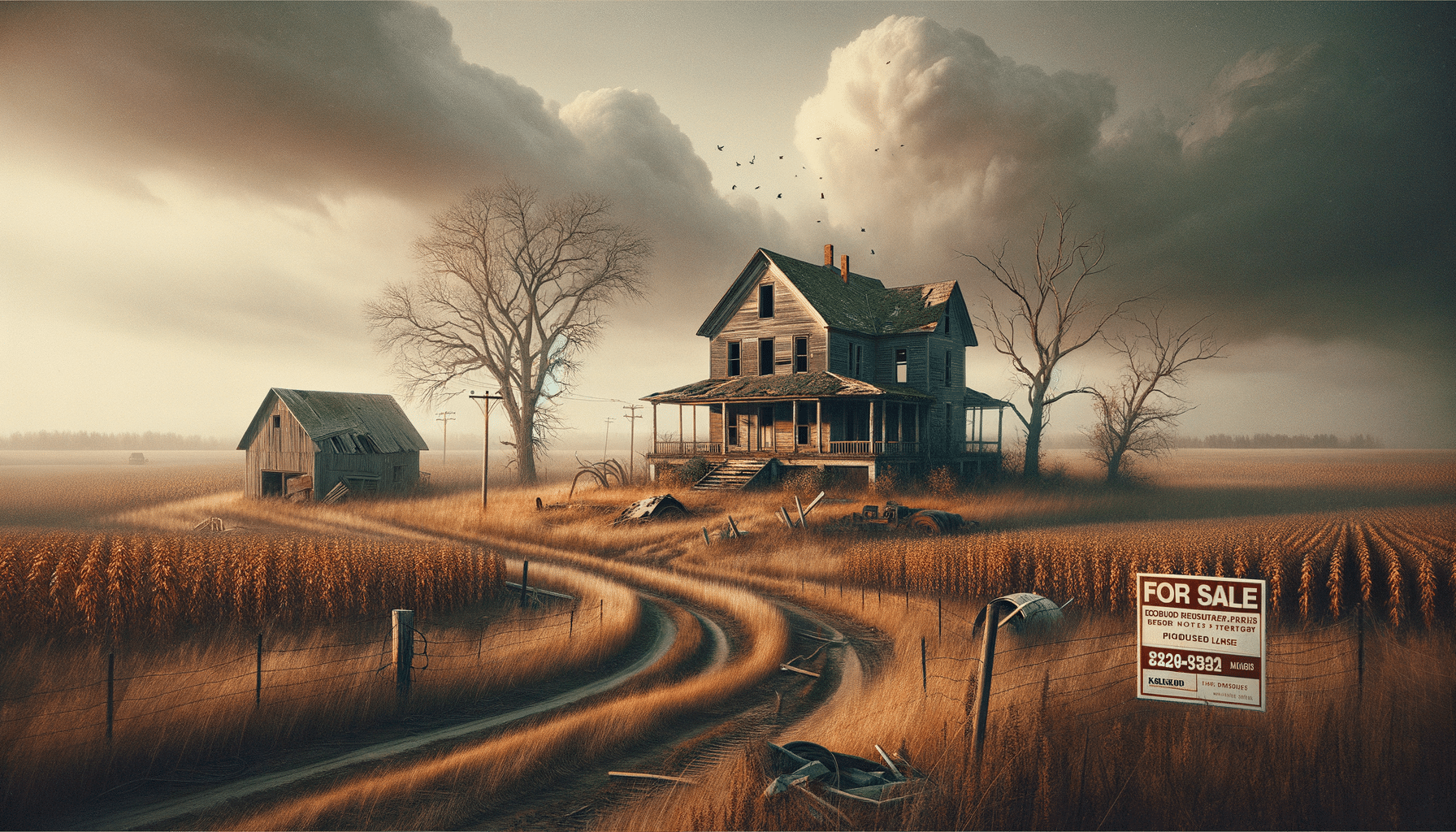

In the vast expanses of rural America, bank-owned land has become an intriguing facet of the real estate market. These properties, often acquired through foreclosure, represent a significant opportunity for those looking to enter agriculture or expand their current operations. Bank-owned lands are scattered across various states, each offering unique characteristics and challenges.

Foreclosure often results from financial difficulties faced by previous owners, leading banks to repossess these lands. As such, these properties are typically sold at competitive prices, making them attractive to potential buyers. However, it’s essential to approach these opportunities with a comprehensive understanding of the local real estate landscape.

When exploring bank-owned land, consider the following:

- Location and Accessibility: Rural properties can vary greatly in terms of accessibility. Consider proximity to major roads and towns, as well as the availability of utilities and services.

- Land Quality: The agricultural viability of the land is crucial. Soil quality, water availability, and climate conditions are all factors that can influence the productivity of the land.

- Legal Considerations: Ensure that there are no outstanding legal issues or liens associated with the property. A thorough title search can prevent future complications.

Ultimately, exploring bank-owned land across rural states requires a blend of due diligence, local knowledge, and a keen eye for potential. These properties can offer a fresh start for those ready to embrace the rural lifestyle.

How Foreclosed Farms Reenter the Market

Foreclosed farms reentering the market is a process that involves several stages, each critical to ensuring the property is ready for a new owner. Once a farm is foreclosed, it typically becomes the property of the bank or financial institution. From there, the process of reentering the market begins.

The first step is often an assessment of the property’s condition. This includes evaluating the land, buildings, and any equipment that may be included in the sale. Banks may choose to invest in basic repairs or maintenance to make the property more appealing to potential buyers.

Next, the property is listed for sale, often through real estate agents who specialize in rural properties. These agents understand the nuances of selling agricultural land and can effectively market the property to the right audience. The marketing strategy might include highlighting the potential uses of the land, such as farming, ranching, or development.

During this phase, potential buyers have the opportunity to inspect the property and conduct their due diligence. This step is crucial, as it allows buyers to understand the full scope of what they are purchasing, including any necessary repairs or improvements.

Once a buyer is found, the final stage involves negotiating the terms of the sale and finalizing the transaction. This process can be complex, especially if there are multiple interested parties, but it ultimately leads to the farm reentering the market under new ownership.

Foreclosed farms can offer unique opportunities for buyers looking to enter the agricultural sector or expand their holdings. By understanding the reentry process, buyers can better navigate the complexities of purchasing such properties.

Things to Know Before Considering a Reclaimed Farm

Considering a reclaimed farm involves understanding several critical aspects that can influence your decision. These farms, often bank-owned, offer a range of opportunities but also come with specific challenges that potential buyers need to be aware of.

Firstly, it’s essential to understand the history of the property. Knowing why the farm was foreclosed can provide insights into potential issues, such as financial difficulties or operational challenges faced by previous owners. This knowledge can help you assess whether similar problems might arise and how to mitigate them.

Another important consideration is the condition of the farm’s infrastructure. This includes buildings, fences, irrigation systems, and any machinery that may be included in the sale. Conducting a thorough inspection is crucial to identifying any repairs or upgrades needed to make the farm operational.

Additionally, assessing the agricultural potential of the land is vital. This involves evaluating soil quality, water resources, and climate conditions, all of which can affect the types of crops or livestock that can be supported. Consulting with agricultural experts or local extension services can provide valuable insights into the land’s potential.

Before proceeding with a purchase, consider the financial implications. This includes not only the purchase price but also ongoing costs such as maintenance, taxes, and potential improvements. Creating a detailed budget can help ensure that the investment is financially viable in the long term.

Ultimately, reclaimed farms offer a chance to own a piece of rural America and engage in agricultural pursuits. However, thorough research and careful planning are essential to making a successful investment.

The Role of Banks in Managing Foreclosed Properties

Banks play a pivotal role in managing foreclosed properties, particularly when it comes to rural lands and farms. Once a property is foreclosed, banks assume ownership and are responsible for maintaining and eventually selling the property. This process involves several key responsibilities and strategies.

Firstly, banks must secure the property to prevent vandalism or unauthorized use. This may involve hiring security services or installing surveillance systems. Maintaining the property’s condition is also crucial, as neglect can lead to deterioration and decreased market value.

Banks often work with real estate agents who specialize in selling rural properties. These agents are tasked with marketing the property to potential buyers, highlighting its features and potential uses. Effective marketing strategies can include online listings, open houses, and targeted advertising to reach interested parties.

In some cases, banks may choose to invest in minor repairs or improvements to enhance the property’s appeal. This can include fixing fences, repairing buildings, or improving access roads. Such investments can make the property more attractive to buyers and potentially increase its sale price.

Throughout this process, banks must also navigate legal and regulatory requirements associated with selling foreclosed properties. This includes ensuring clear titles, resolving any outstanding liens, and complying with state and federal regulations. Legal expertise is often required to manage these complexities.

By effectively managing foreclosed properties, banks can facilitate their reentry into the market, providing opportunities for new owners to invest in rural lands and farms.

Opportunities and Challenges of Investing in Bank-Owned Farms

Investing in bank-owned farms presents a unique blend of opportunities and challenges. For those interested in agriculture or rural land ownership, these properties can offer significant benefits, but they also require careful consideration and planning.

One of the primary opportunities is the potential for acquiring land at a reduced cost. Bank-owned farms are often sold at competitive prices, making them accessible to a broader range of buyers. This affordability can provide a pathway for individuals looking to enter the agricultural sector or expand their current operations.

Additionally, bank-owned farms may come with existing infrastructure, such as barns, equipment, or irrigation systems. While these assets can be advantageous, it’s essential to assess their condition and determine any necessary repairs or upgrades.

However, investing in bank-owned farms also presents challenges. One of the main concerns is the potential for hidden issues, such as environmental problems or unresolved legal matters. Conducting thorough due diligence, including environmental assessments and title searches, is crucial to uncovering any potential risks.

Another challenge is the need for substantial initial investment in terms of time, money, and effort. Preparing the land for agricultural use, repairing infrastructure, and managing daily operations can be demanding tasks that require careful planning and resource allocation.

Despite these challenges, bank-owned farms can offer a rewarding investment opportunity for those willing to invest the necessary time and effort. By approaching the process with diligence and a clear understanding of the potential risks and rewards, investors can successfully navigate the complexities of purchasing and managing these properties.