Understanding Buy Here Pay Here Boat Options in the U.S.

Introduction to Buy Here Pay Here Boat Dealers

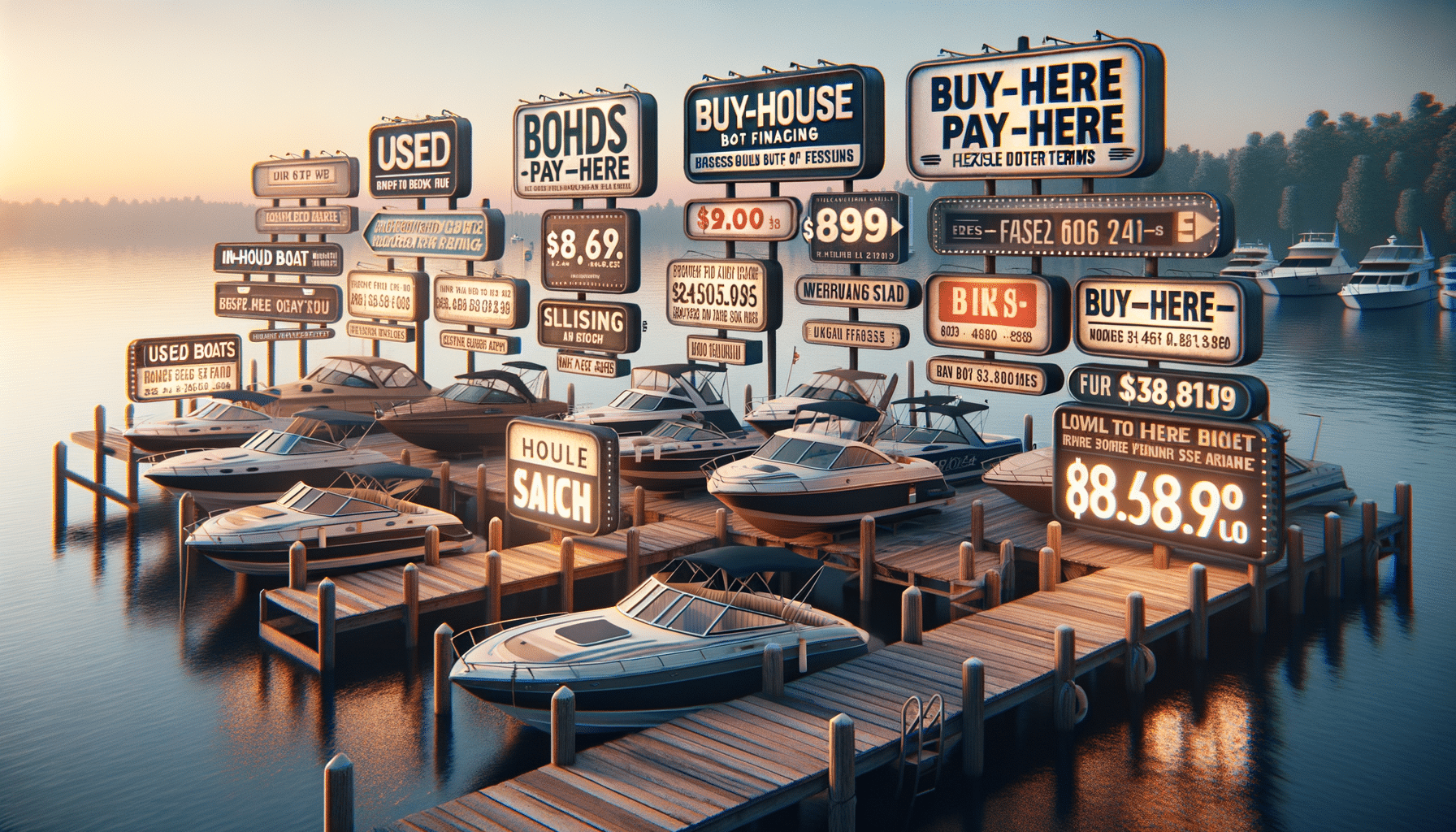

Buy-here-pay-here (BHPH) boat dealerships present a unique opportunity for individuals interested in owning a boat but who may face challenges with traditional financing options. These dealerships offer a straightforward approach by providing in-house financing, allowing customers to make payments directly to the dealer rather than through a third-party lender. This model is particularly appealing for those with less-than-perfect credit scores, as it often involves more lenient approval criteria.

The BHPH model is designed to simplify the purchasing process, making it accessible to a broader audience. Customers can benefit from a streamlined application process, often requiring minimal documentation. Additionally, BHPH dealers typically offer flexible purchase terms, which can be tailored to fit the buyer’s financial situation. This flexibility helps make boat ownership attainable for many who might otherwise be unable to secure financing.

How Buy Here Pay Here Boat Dealers Operate

Understanding how BHPH boat dealers operate is crucial for potential buyers. These dealerships function by offering both sales and financing under one roof, effectively bypassing traditional financial institutions. This setup provides several advantages, particularly in terms of convenience and accessibility.

At a BHPH dealership, the process begins with selecting a boat from their inventory. These dealerships often specialize in used boats, which are typically more affordable than new models. Once a boat is chosen, the buyer and dealer work together to establish a financing plan that suits the buyer’s budget. This plan usually involves a down payment followed by regular installment payments.

One of the key benefits of this approach is the flexibility it offers. BHPH dealerships can adjust terms such as the length of the loan and the size of the payments, making it easier for buyers to manage their finances. Additionally, because the dealer handles the financing, they have a vested interest in ensuring the buyer can meet the payment obligations, often leading to a more personalized service experience.

Exploring Used Boats with Flexible Purchase Terms

Used boats with flexible purchase terms are a significant draw for many buyers at BHPH dealerships. These boats offer a cost-effective entry point into boat ownership, often coming with lower price tags and more negotiable terms than new boats. This affordability, coupled with flexible financing, makes them an attractive option for first-time buyers or those with budget constraints.

When exploring used boats, potential buyers should consider several factors to ensure they make a wise investment. First, it’s essential to assess the boat’s condition thoroughly. This includes examining the hull, engine, and interior to identify any potential issues that could require costly repairs. Buyers should also review the boat’s history, including any previous ownership details and maintenance records.

Flexible purchase terms can significantly enhance the appeal of a used boat. These terms might include reduced down payments, extended loan periods, or adjustable interest rates. Such flexibility allows buyers to tailor their purchase to their financial situation, making it easier to manage the costs associated with boat ownership.

What to Know About In-House Boat Financing

In-house boat financing is a cornerstone of the BHPH model, providing an alternative to traditional lending methods. This type of financing involves the dealership acting as the lender, which can simplify the approval process and make it more accessible to a wider range of buyers.

One of the primary advantages of in-house financing is the ability to negotiate terms directly with the dealer. This direct interaction allows for greater flexibility in structuring the loan, accommodating the buyer’s specific financial needs. For instance, buyers can often negotiate the length of the loan and the size of the monthly payments, making it easier to fit the purchase into their budget.

However, potential buyers should be aware of certain considerations when opting for in-house financing. Interest rates may be higher than those offered by traditional lenders, reflecting the increased risk taken on by the dealership. Additionally, buyers should ensure they fully understand the terms of the agreement, including any penalties for late payments or early payoff.

Conclusion: Navigating the BHPH Boat Market

For those considering boat ownership, buy-here-pay-here boat programs offer a viable and flexible pathway. By understanding how these dealerships operate and the benefits of in-house financing, potential buyers can make informed decisions that align with their financial circumstances and boating aspirations.

When exploring BHPH options, it’s crucial to thoroughly evaluate the boats on offer and understand the terms of any financing agreements. By doing so, buyers can enjoy the freedom and adventure that come with boat ownership, without overextending their financial resources.

Ultimately, the BHPH model provides an accessible entry point into the world of boating, making it possible for more individuals to experience the joys of life on the water. With careful consideration and planning, this approach can lead to a rewarding and enjoyable boating experience.