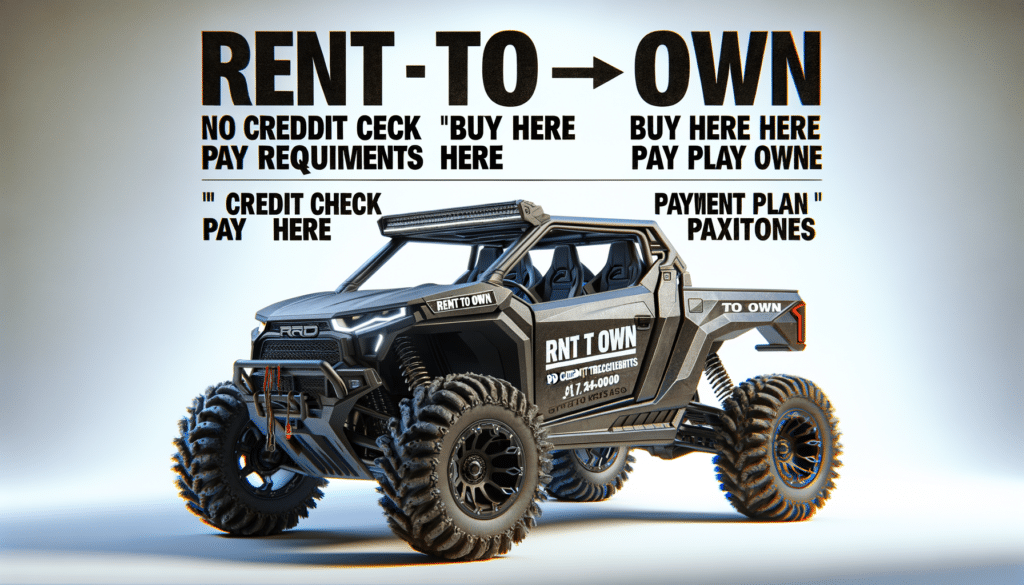

Understanding Rent to Own UTV Programs

Rent to own UTV programs are an attractive option for individuals who need a utility terrain vehicle but may not have the immediate funds to purchase one outright. These programs allow potential buyers to rent a UTV with the option to purchase it after a set period. This approach can be particularly beneficial for those who are building credit or prefer to test a vehicle before committing to a full purchase.

One of the key advantages of rent to own programs is flexibility. Customers can enjoy the use of a UTV while making regular payments that contribute towards ownership. This can be a practical solution for farmers, outdoor enthusiasts, or businesses needing temporary vehicle access. Additionally, these programs often do not require a credit check, making them accessible to a wider audience.

When considering a rent to own UTV, it’s essential to understand the terms and conditions. Look for agreements that clearly outline the payment schedule, total cost, and any additional fees. It’s also wise to compare multiple offers to find a plan that suits your financial situation and usage needs. By doing so, you can ensure that you make a well-informed decision that aligns with your budget and lifestyle.

Exploring UTV Financing Options

For those interested in purchasing a UTV outright, various financing options are available. Many dealerships offer financing plans that can be tailored to fit different budgets and credit profiles. These plans can include low-interest rates and extended payment terms, making it easier to manage the cost of a new or used UTV.

Financing a UTV typically involves a credit check, but there are options available for those with less than perfect credit. Some dealers offer no credit check financing, though these may come with higher interest rates or require a larger down payment. It’s crucial to review the terms of any financing agreement carefully to ensure that it meets your financial needs.

When exploring financing options, consider the following factors:

- Interest Rates: Compare rates from different lenders to find the most competitive option.

- Loan Terms: Look for terms that offer flexibility in payment schedules.

- Down Payment: Determine how much you can afford to put down upfront.

- Additional Fees: Be aware of any hidden costs that may be included in the financing agreement.

By thoroughly evaluating these aspects, you can secure a financing plan that helps you acquire the UTV you need without overextending your budget.

Finding Buy Here Pay Here UTV Dealers

Buy here pay here (BHPH) UTV dealerships provide an alternative for buyers who may struggle with traditional financing methods. These dealers offer in-house financing, allowing customers to make payments directly to the dealership rather than through a third-party lender. This can be particularly advantageous for individuals with poor credit or those who prefer a more straightforward purchasing process.

One of the main benefits of BHPH dealerships is their willingness to work with customers who have a limited credit history. They often have more lenient credit requirements and can tailor payment plans to fit individual circumstances. However, it’s important to note that interest rates at BHPH dealerships may be higher compared to traditional lenders.

When considering a BHPH dealership, it’s essential to research and compare different options. Look for dealers with a solid reputation and transparent terms. Consider visiting multiple dealerships to test drive various UTV models and discuss financing options. By doing so, you can find a UTV and payment plan that best suits your needs.

In summary, buy here pay here UTV dealers offer a viable solution for those who need flexible financing options. By understanding the terms and conducting thorough research, you can make an informed decision that supports your off-road adventures without financial strain.