Rent to Own Handicap Vans: Exploring Accessible Vehicle Options

Understanding Rent to Own Wheelchair Vans

Rent to own wheelchair vans present a flexible solution for individuals needing accessible transportation without the immediate financial burden of purchasing a vehicle outright. This model allows users to rent a van with the option to purchase it at the end of the lease term. It’s an attractive choice for those who may not qualify for traditional financing or prefer to test the vehicle’s suitability before committing to a purchase.

One of the main advantages of a rent to own scheme is the ability to spread the cost over time. This can be particularly beneficial for families or individuals on fixed incomes. Monthly payments are typically applied towards the eventual purchase price, allowing the user to build equity in the vehicle over time. Additionally, these arrangements often come with flexible terms, enabling customization based on the user’s financial situation.

When considering a rent to own wheelchair van, it’s crucial to evaluate the terms of the agreement carefully. Key considerations include the length of the lease, the total cost of the vehicle, and any additional fees. It’s also important to understand the condition of the van and any maintenance responsibilities. By doing thorough research and understanding the terms, users can make informed decisions that align with their mobility needs and financial capabilities.

Accessible Van Financing Options

Financing accessible vans can be a challenging process, but there are several options available to make these vehicles more affordable. Traditional auto loans are one option, though they may require a good credit score and a stable income. For those who may not meet these criteria, specialized lenders offer financing specifically for accessible vehicles, often with more flexible terms.

Another avenue to explore is government assistance programs. Various federal and state programs provide financial aid to individuals with disabilities to help cover the cost of adaptive vehicles. These programs can significantly reduce the financial burden, making it easier for individuals to own a van tailored to their needs.

In addition to loans and assistance programs, some dealerships offer in-house financing options. These plans may come with higher interest rates but can be a viable choice for those with less-than-perfect credit. It’s important to compare all available options, consider the long-term financial implications, and choose a plan that fits your budget and lifestyle.

Exploring Used Handicap Vans

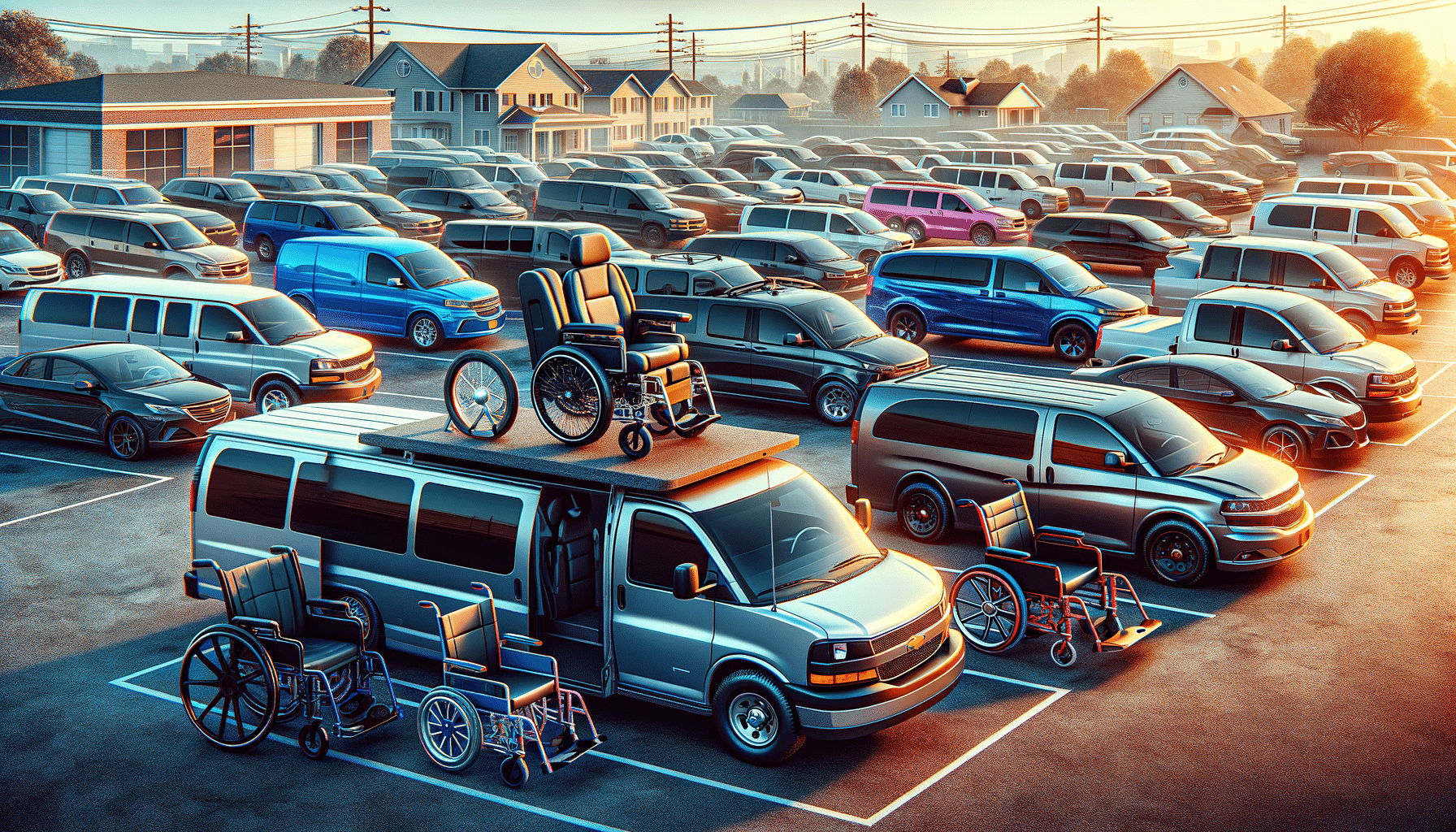

For those looking to save on costs, used handicap vans are a practical alternative to new models. These vehicles often come at a significantly lower price, making them accessible to a broader range of buyers. When searching for used handicap vans, it’s essential to prioritize quality and reliability to ensure the vehicle meets your mobility needs.

Start by researching local dealerships and private sellers who specialize in accessible vehicles. Many dealerships offer certified pre-owned programs, which include thorough inspections and warranties, providing peace of mind to buyers. Additionally, online marketplaces can be a valuable resource for finding used vans, though it’s crucial to verify the condition and history of the vehicle before making a purchase.

When evaluating a used handicap van, consider factors such as the mileage, age, and any previous modifications. A vehicle history report can provide insight into past ownership and maintenance records. It’s also advisable to have a trusted mechanic inspect the van to identify any potential issues. By taking these steps, buyers can find a reliable used van that offers both functionality and affordability.