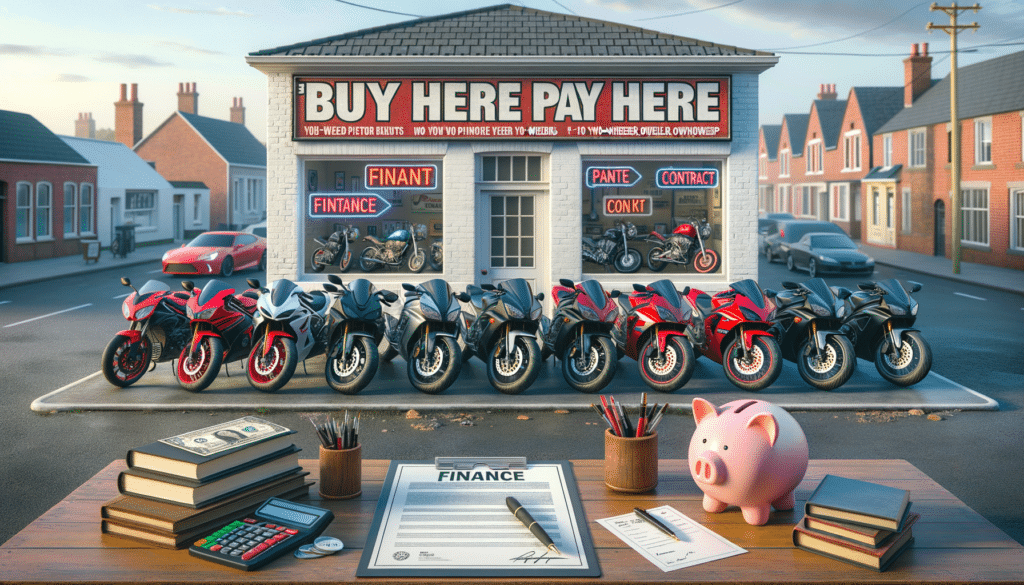

Understanding Buy Here Pay Here Dealerships

Buy Here Pay Here (BHPH) dealerships offer a unique solution for individuals who might face challenges securing traditional financing. Unlike conventional dealerships, BHPH dealers provide in-house financing, allowing buyers to make payments directly to the dealership. This model is particularly beneficial for those with limited or poor credit histories, as it often bypasses the need for a third-party lender.

The process at a BHPH dealership is straightforward. Buyers select a vehicle, negotiate terms, and make payments directly to the dealership, often on a weekly or bi-weekly basis. This direct payment system can help customers build or rebuild their credit over time, provided payments are made consistently and on schedule.

However, it’s essential to be aware of the potential drawbacks. Interest rates at BHPH dealerships can be higher than those from traditional lenders, reflecting the increased risk the dealership assumes by financing customers with less-than-perfect credit. Additionally, the selection of vehicles might be more limited, focusing on used cars and motorcycles.

- In-house financing

- Direct payment to dealership

- Potentially higher interest rates

Buy Here Pay Here Motorcycles: A Closer Look

For motorcycle enthusiasts, the dream of owning a bike can sometimes be hindered by financial constraints. Buy Here Pay Here motorcycles offer a viable alternative for those looking to hit the road without the backing of traditional financial institutions. These dealerships operate similarly to their car counterparts, providing flexible payment options tailored to the buyer’s financial situation.

One of the primary advantages of BHPH motorcycle dealerships is accessibility. They often cater to individuals who might not qualify for loans from banks or credit unions, making motorcycle ownership feasible for a broader audience. This inclusivity is a significant draw for first-time buyers or those with a patchy credit history.

However, potential buyers should approach these options with caution. As with BHPH car dealerships, the interest rates can be significantly higher, and the selection of motorcycles may not include the latest models. It’s crucial to thoroughly research and understand the terms of the agreement before committing to ensure it aligns with your financial capabilities and long-term goals.

- Flexible payment options

- Accessible to a broader audience

- Higher interest rates

Exploring Used Motorcycle Financing Options

For those considering a used motorcycle, various financing options can help make the purchase more manageable. While BHPH dealerships are one route, traditional financing options should not be overlooked. Banks, credit unions, and online lenders offer loans specifically tailored for used motorcycles, often with competitive interest rates and flexible terms.

When exploring these options, it’s essential to compare interest rates, loan terms, and any associated fees. Traditional lenders typically require a credit check, which can be a barrier for some, but they often provide more favorable terms than BHPH dealerships. Additionally, some lenders offer pre-approval, allowing buyers to shop with confidence, knowing their financing is secured.

For those with less-than-perfect credit, exploring co-signer options or saving for a larger down payment can improve loan approval chances and reduce interest rates. It’s also worth considering dealer financing, which, while similar to BHPH, might offer different terms and conditions.

- Bank and credit union loans

- Online lenders

- Dealer financing

Comparing Financing Options for Motorcycles

When deciding on the right financing option for a motorcycle, it’s crucial to weigh the pros and cons of each method. Buy Here Pay Here dealerships offer accessibility and convenience but at the cost of higher interest rates and potentially less favorable terms. In contrast, traditional financing through banks or credit unions might require a more robust credit score but often provides more competitive rates and terms.

Another factor to consider is the type of motorcycle being purchased. For those looking at used motorcycles, traditional lenders might offer more favorable terms compared to new models. It’s essential to consider the total cost of ownership, including insurance, maintenance, and any additional fees associated with the loan.

Ultimately, the decision should be based on an individual’s financial situation, credit history, and long-term goals. By thoroughly researching and comparing options, buyers can make an informed decision that aligns with their needs and budget.

- Pros and cons of BHPH

- Traditional financing benefits

- Total cost of ownership considerations

Conclusion: Making Motorcycle Ownership a Reality

For many, the allure of motorcycle ownership is undeniable, offering freedom and adventure on the open road. Buy Here Pay Here motorcycles provide an accessible entry point for those who might face challenges with traditional financing. While this option comes with its considerations, such as higher interest rates, it serves as a valuable alternative for many aspiring riders.

By exploring all available financing options, from BHPH dealerships to traditional lenders, individuals can find a path to motorcycle ownership that suits their financial situation. Whether it’s through strategic planning, saving for a down payment, or considering a co-signer, the dream of owning a motorcycle is within reach for many.

Ultimately, the key is to approach the process with diligence and awareness, ensuring that the chosen financing method aligns with personal financial goals and capabilities. With the right approach, the thrill of the ride is just around the corner.