Exploring Bank-Owned SUVs: Where to Start and What to Expect

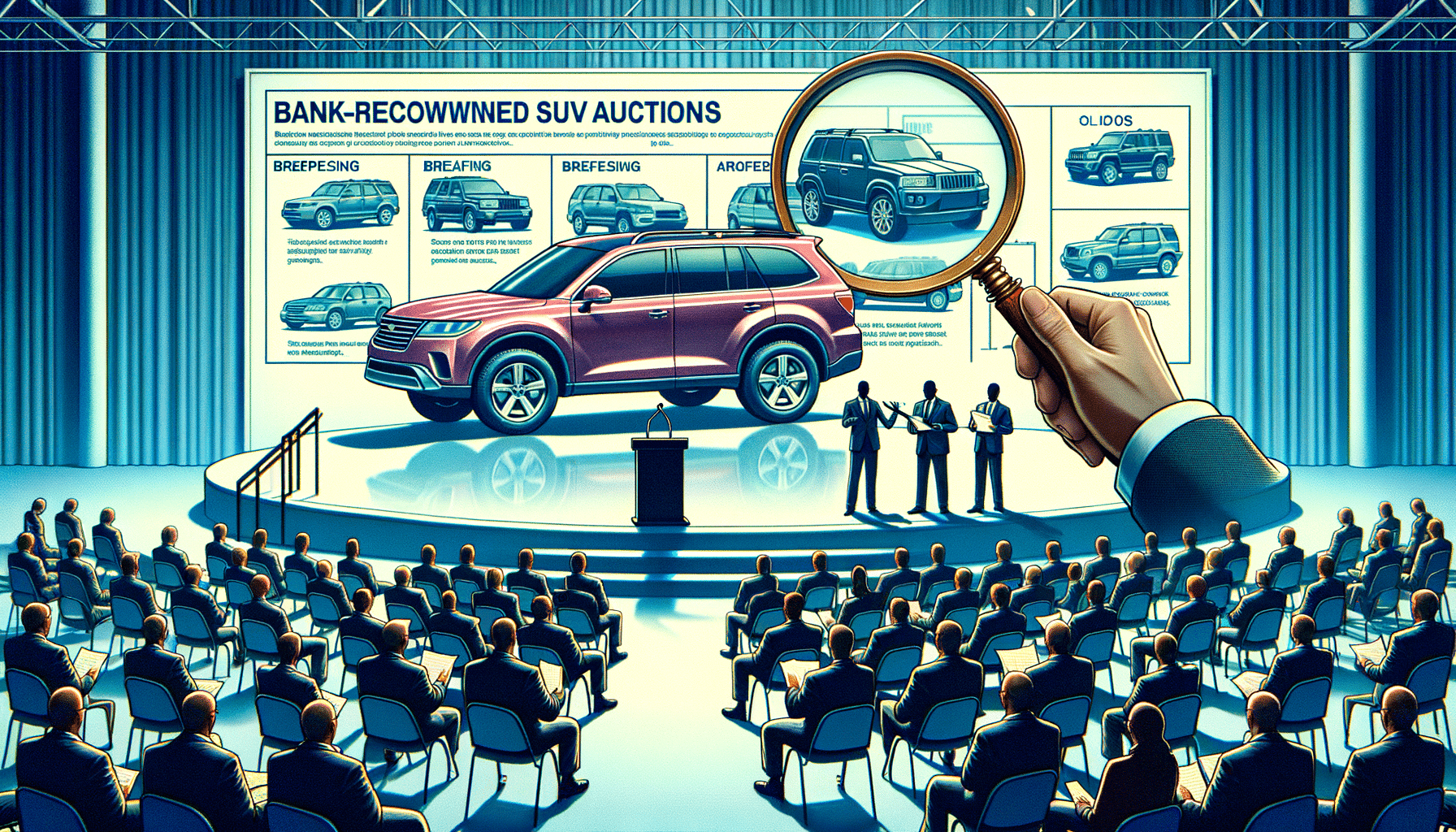

Introduction to Bank-Owned SUV Auctions

Bank-owned SUV auctions present a unique opportunity for car buyers looking to acquire a vehicle at a potentially lower cost. These auctions typically feature vehicles that have been repossessed by financial institutions due to loan defaults. Understanding the mechanics of these auctions can provide a competitive edge to prospective buyers.

At these auctions, banks aim to recover the outstanding loan balance by selling the repossessed vehicles. The process is straightforward: vehicles are listed for auction, and interested buyers place bids. The highest bidder wins the vehicle. However, it’s essential to note that these auctions can be competitive, with seasoned bidders often participating, so preparation is key.

One of the advantages of bank-owned auctions is the variety of SUVs available. From compact crossovers to larger family models, the selection can be diverse. However, the condition of these vehicles can vary significantly, so thorough research and inspection are crucial. Many auctions allow potential buyers to inspect vehicles beforehand, providing a chance to assess the car’s condition and history.

What to Know Before Bidding on a Repo SUV

Before diving into the bidding process for a repossessed SUV, there are several critical factors to consider. First and foremost, understanding the vehicle’s history is paramount. Many auctions provide a vehicle history report, which can offer insights into past ownership, accident history, and maintenance records. This information is invaluable in assessing the vehicle’s value and potential future costs.

Another essential consideration is setting a budget. It’s easy to get caught up in the excitement of an auction, but establishing a firm spending limit can prevent overspending. Remember to include additional costs such as taxes, registration, and potential repairs in your budget.

Familiarizing yourself with the auction process is also beneficial. Some auctions may require registration or a deposit to participate. Understanding the rules and procedures can help avoid surprises on the day of the auction. Additionally, attending a few auctions as an observer can provide insight into bidding strategies and the overall environment.

Pros and Cons of Buying a Repossessed SUV

Purchasing a repossessed SUV comes with its own set of advantages and disadvantages. On the positive side, these vehicles are often sold at a lower price than their market value, providing a cost-effective option for buyers. Additionally, the variety of models available at auctions can offer more choices compared to traditional dealerships.

However, there are potential downsides to consider. The condition of repossessed vehicles can be unpredictable, and they may require significant repairs or maintenance. Unlike buying from a dealership, there are typically no warranties or guarantees with auction purchases, which can increase the risk for buyers.

Furthermore, the auction environment can be challenging for inexperienced bidders. The fast-paced nature and competitive atmosphere can lead to impulsive decisions. It’s crucial to stay informed, prepared, and calm during the bidding process to make the most of the opportunity.

Preparing for a Bank-Owned SUV Auction

Preparation is key when considering participating in a bank-owned SUV auction. Start by researching upcoming auctions in your area and reviewing the list of available vehicles. This will help identify potential options that meet your criteria and budget.

Once you’ve identified a vehicle of interest, gather as much information as possible. This includes obtaining a vehicle history report, inspecting the vehicle if allowed, and researching common issues associated with the model. This information will aid in making an informed decision during the auction.

It’s also wise to attend a few auctions as a spectator before participating. Observing the bidding process can provide valuable insights into strategies and common practices. Additionally, consider setting a maximum bid limit beforehand to prevent overspending in the heat of the moment.

Conclusion: Weighing Your Options

Bank-owned SUV auctions offer an exciting opportunity for savvy buyers to acquire a vehicle at a potentially reduced cost. However, it’s essential to approach these auctions with careful consideration and preparation. By understanding the auction process, researching vehicles, and setting a budget, buyers can navigate the complexities of repo SUV purchases effectively.

Ultimately, whether purchasing a repossessed SUV is the right choice depends on individual needs and circumstances. Weighing the pros and cons, and being well-prepared, can lead to a successful purchase that meets both your financial and vehicular needs.