Introduction to Tractor and Tractor Trailer Financing

The world of agriculture and logistics often relies on the robust performance of tractors and tractor trailers. However, acquiring these essential vehicles can be a significant financial undertaking. Fortunately, various financing options are available to ease this burden. Whether you’re eyeing a new or used tractor, or considering a rent-to-own arrangement, understanding these financing avenues is crucial. This article delves into the different financing options, helping you make informed decisions that align with your budget and operational needs.

Understanding Tractor Trailer Financing

Tractor trailer financing is a popular choice among businesses that need to expand their fleet without depleting their capital reserves. This type of financing allows businesses to acquire trailers through loans or leases, making it easier to manage cash flow. Financing terms can vary greatly, often depending on the financial health of the business and the condition of the trailers being financed.

Key benefits of tractor trailer financing include:

- Preservation of capital: Financing allows businesses to retain their cash reserves for other operational needs.

- Tax benefits: Depending on the financing structure, businesses might enjoy certain tax advantages.

- Flexibility: Financing options can be tailored to suit the specific needs of the business, including payment schedules and interest rates.

When considering tractor trailer financing, it’s essential to compare different lenders and their terms. Look for lenders who offer competitive rates and flexible payment options. Additionally, ensure that the financing terms align with your business’s cash flow and growth projections.

Exploring Used Tractor Financing

Used tractors present a cost-effective alternative for businesses looking to expand their fleet without the expense of new equipment. Financing used tractors can be an economical choice, often accompanied by lower monthly payments compared to new tractors. However, it’s crucial to carefully assess the condition and history of the used tractor to ensure it meets your operational requirements.

When financing a used tractor, consider the following factors:

- Depreciation: Used tractors have already undergone significant depreciation, which can be advantageous in terms of lower financing amounts.

- Maintenance history: Ensure that the tractor has been well-maintained and that any potential issues have been addressed.

- Resale value: Consider the tractor’s potential resale value, as this can affect your overall investment.

Financing terms for used tractors may vary, so it’s important to shop around and compare offers from different lenders. Look for lenders who specialize in agricultural equipment and offer favorable terms for used tractors.

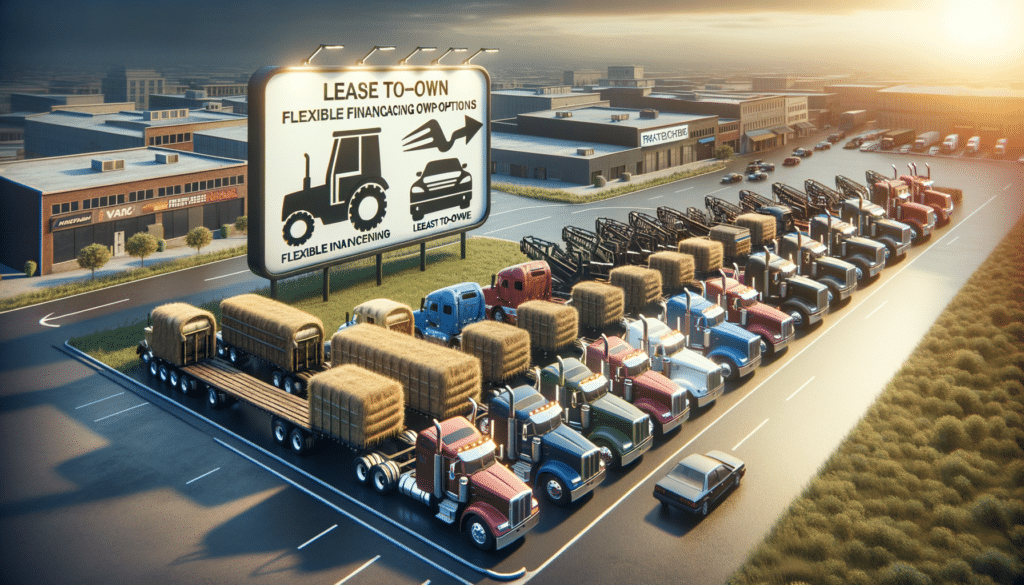

Rent-to-Own and Buy Here Pay Here Tractor Trailers

Rent-to-own and buy here pay here options provide alternative pathways to tractor trailer ownership. These options are particularly appealing to businesses or individuals with limited access to traditional financing due to credit constraints.

Rent-to-own agreements allow users to rent a tractor trailer with the option to purchase it at the end of the lease term. This option provides flexibility and the ability to test the equipment before committing to a purchase. On the other hand, buy here pay here arrangements offer in-house financing, often bypassing the need for third-party lenders. This can be advantageous for those with less-than-perfect credit scores.

Consider these points when evaluating rent-to-own and buy here pay here options:

- Flexibility: Rent-to-own agreements offer the flexibility to return the equipment if it doesn’t meet your needs.

- Credit requirements: Buy here pay here options may have more lenient credit requirements, making them accessible to a broader audience.

- Ownership potential: Both options provide a clear path to ownership, allowing you to build equity over time.

These financing options can be a viable solution for those looking to acquire tractor trailers without traditional financing. However, it’s important to carefully review the terms and conditions to ensure they align with your financial goals.

Conclusion: Making the Right Choice for Tractor and Trailer Financing

Choosing the right financing option for tractors and tractor trailers is a crucial decision that can impact your business’s financial health and operational efficiency. Whether opting for traditional loans, used equipment financing, or alternative options like rent-to-own or buy here pay here, it’s essential to weigh the pros and cons carefully.

Consider your business’s current financial situation, future growth plans, and operational needs when selecting a financing option. By doing so, you can ensure that you make a choice that supports your business’s success and stability. With the right financing in place, you can confidently expand your fleet and enhance your business operations.