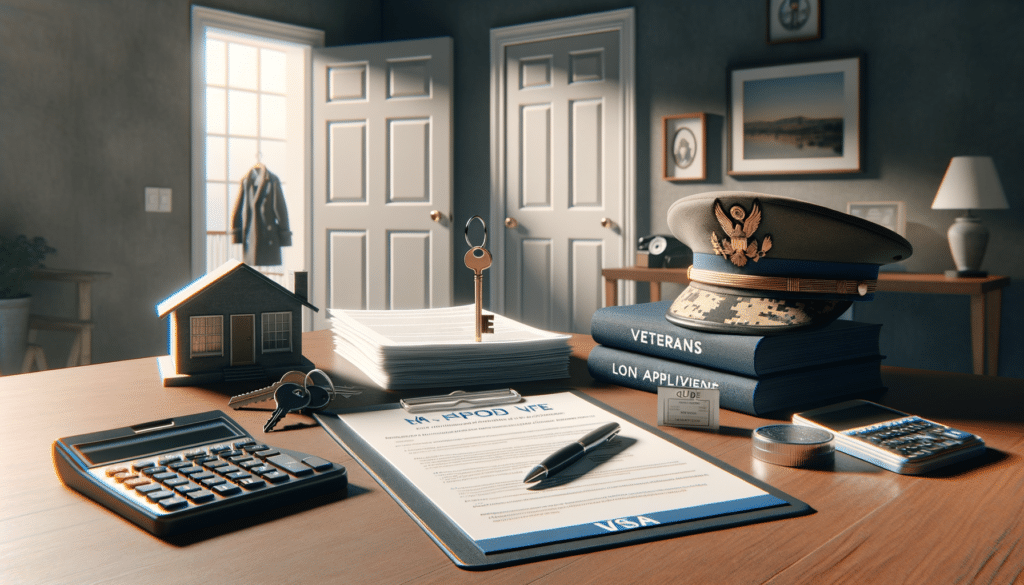

Understanding the VA Loan Application Process

Applying for a VA loan might seem daunting, but with the right guidance, it can be a straightforward process. The first step in applying for a VA loan is to obtain a Certificate of Eligibility (COE). This document confirms your eligibility for a VA loan based on your service history. You can apply for a COE through the VA’s eBenefits portal, by mail, or with the help of a lender. Once you have your COE, the next step is to find a lender that participates in the VA home loan program. It’s essential to compare different lenders to find one that offers competitive rates and terms.

After selecting a lender, you’ll need to complete a loan application and provide necessary documentation, such as proof of income, employment history, and credit information. The lender will then assess your financial situation to determine if you qualify for a loan. If approved, you’ll receive a pre-approval letter, which can strengthen your position when making an offer on a home.

Throughout the application process, it’s crucial to stay organized and responsive to any requests from your lender. Being proactive can help ensure a smooth and timely approval process, allowing you to move forward with purchasing your home.

VA Loan Requirements for Veterans

VA loans are designed to help veterans, active-duty service members, and eligible spouses become homeowners. To qualify for a VA loan, you must meet specific service requirements. Generally, veterans who served 90 consecutive days during wartime or 181 days during peacetime are eligible. Additionally, National Guard and Reserve members may qualify after six years of service.

Besides service requirements, there are financial criteria that applicants must meet. Lenders typically require a minimum credit score, usually around 620, although this can vary. It’s also important to demonstrate a stable income and manageable debt-to-income ratio. Unlike conventional loans, VA loans do not require a down payment, making them an attractive option for many veterans.

Another critical requirement is the property itself. It must meet the VA’s minimum property requirements, ensuring it is safe, sound, and sanitary. This includes aspects like adequate roofing, reliable heating and cooling systems, and no pest infestations. The property must also be the veteran’s primary residence.

The Benefits of VA Home Loans

VA home loans offer numerous advantages that make them an appealing choice for veterans and military families. One of the most significant benefits is the absence of a down payment requirement, which can lower the initial cost of purchasing a home. Additionally, VA loans do not require private mortgage insurance (PMI), which can result in substantial savings over time.

Another advantage is the competitive interest rates offered by VA loans. These rates are often lower than those of conventional loans, making monthly payments more affordable. Furthermore, VA loans come with flexible credit requirements, providing opportunities for veterans who may have less-than-perfect credit histories.

VA loans also offer protection to borrowers through the VA’s assistance programs. If a borrower faces financial difficulties, the VA can intervene with the lender to negotiate repayment plans or loan modifications. This support can be invaluable in helping veterans keep their homes during challenging times.

- No down payment required

- No private mortgage insurance

- Competitive interest rates

- Flexible credit requirements

- VA assistance programs

Preparing for VA Loan Pre-Approval

Securing pre-approval for a VA loan is a crucial step in the home buying process. It not only confirms your eligibility but also helps you understand how much you can afford. To prepare for pre-approval, start by gathering essential documents, including your COE, recent pay stubs, tax returns, and bank statements. Having these documents ready can expedite the pre-approval process.

It’s also wise to review your credit report before applying. Ensure there are no errors, and take steps to improve your credit score if necessary. Paying down existing debts and making timely payments can positively impact your creditworthiness.

Once you’ve gathered your documents and reviewed your credit, reach out to a VA-approved lender to begin the pre-approval process. The lender will assess your financial situation and provide a pre-approval letter, which can be a powerful tool when making offers on homes. Remember, pre-approval is not a guarantee of final loan approval, but it does indicate that you are a serious buyer with the financial backing to purchase a home.

Conclusion: Taking the Next Steps

Understanding how to apply for a VA loan and meeting the necessary requirements can open the door to homeownership for many veterans and military families. With benefits like no down payment, no PMI, and competitive interest rates, VA loans offer a valuable opportunity for those who have served our country.

By following the steps outlined in this guide, you can navigate the VA loan process with confidence. From obtaining your COE to securing pre-approval, each step brings you closer to owning your dream home. Remember to stay organized, responsive, and proactive throughout the process to ensure a smooth experience. With the right preparation and support, you can successfully achieve your homeownership goals.