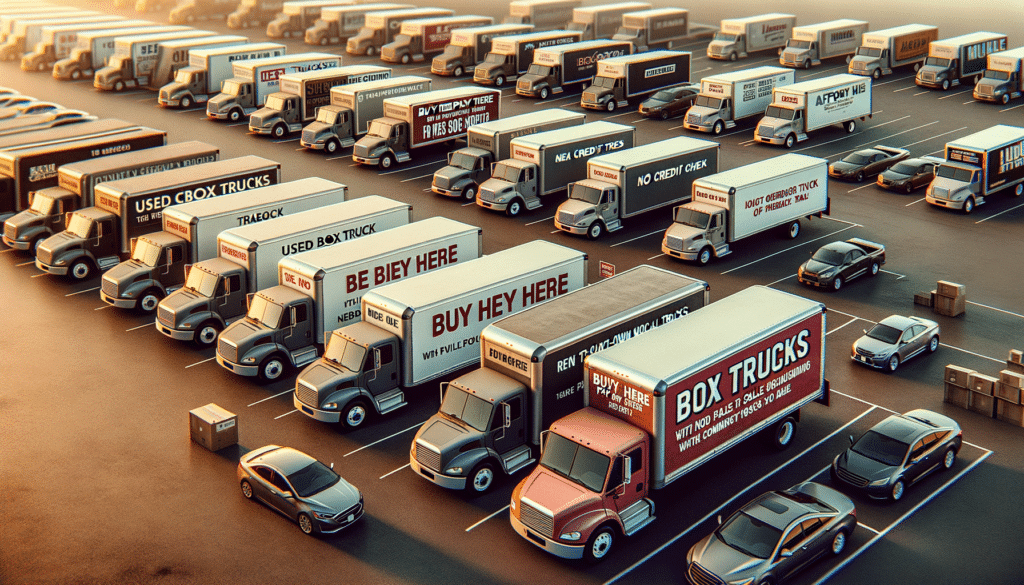

Understanding Buy Here Pay Here Box Trucks

In the realm of commercial vehicle acquisition, “Buy Here Pay Here” (BHPH) programs have emerged as a viable option for businesses and individuals with limited credit history. These programs allow buyers to purchase a vehicle directly from the dealership, which also provides the financing. This setup eliminates the need for third-party lenders, making it easier for those with less-than-perfect credit to secure a vehicle.

The BHPH model is particularly beneficial for small businesses or startups that may not have established credit. By opting for a BHPH box truck, buyers can expect:

- Flexible payment plans tailored to their financial situation.

- A simplified purchasing process with fewer hurdles.

- The opportunity to build or improve credit with consistent payments.

However, it’s crucial to approach these deals with a clear understanding of the terms. Interest rates in BHPH agreements can be higher than traditional loans, reflecting the increased risk for the dealer. Therefore, prospective buyers should carefully review the terms and calculate the total cost of ownership, ensuring it aligns with their budget and business needs.

Exploring Used Box Trucks with No Credit Check

For many, the idea of purchasing a used box truck without a credit check is appealing, especially for those who have faced financial difficulties in the past. This option is often available through specialized dealerships that focus on providing vehicles to individuals with poor or no credit history. The absence of a credit check means the buyer’s financial past does not hinder their ability to acquire a necessary commercial vehicle.

Typically, these dealerships assess the buyer’s current income and ability to make payments, rather than relying on past credit scores. This approach offers several advantages:

- Access to a vehicle essential for business operations without the barrier of credit history.

- Potential for faster approval processes, as fewer financial documents are required.

- Opportunity to prove financial responsibility through timely payments.

While this route can be advantageous, buyers should remain vigilant. The lack of a credit check often comes with higher interest rates and potentially stricter payment terms. It’s essential to ensure that the vehicle’s condition and the terms of purchase are both favorable and sustainable for the buyer’s financial situation.

Affordable Commercial Trucks: Finding Value in the Market

When searching for affordable commercial trucks, buyers often weigh the balance between cost and quality. The used truck market presents numerous opportunities for finding vehicles that offer both reliability and affordability. However, making an informed decision requires careful consideration of several factors.

Firstly, buyers should assess their specific needs. The type of cargo, frequency of use, and operational environment all influence the kind of truck that would be most suitable. Once needs are identified, potential buyers can explore various options, keeping an eye out for:

- Dealerships that specialize in commercial vehicles and offer warranties or service packages.

- Trucks with a documented service history, indicating regular maintenance and care.

- Models known for durability and low maintenance costs, which can reduce long-term expenses.

In addition, leveraging online platforms and local listings can provide a broader view of available trucks, helping buyers to compare prices and features. By taking the time to research and evaluate options, buyers can find commercial trucks that meet their needs without breaking the bank, ensuring a smart investment for their business.