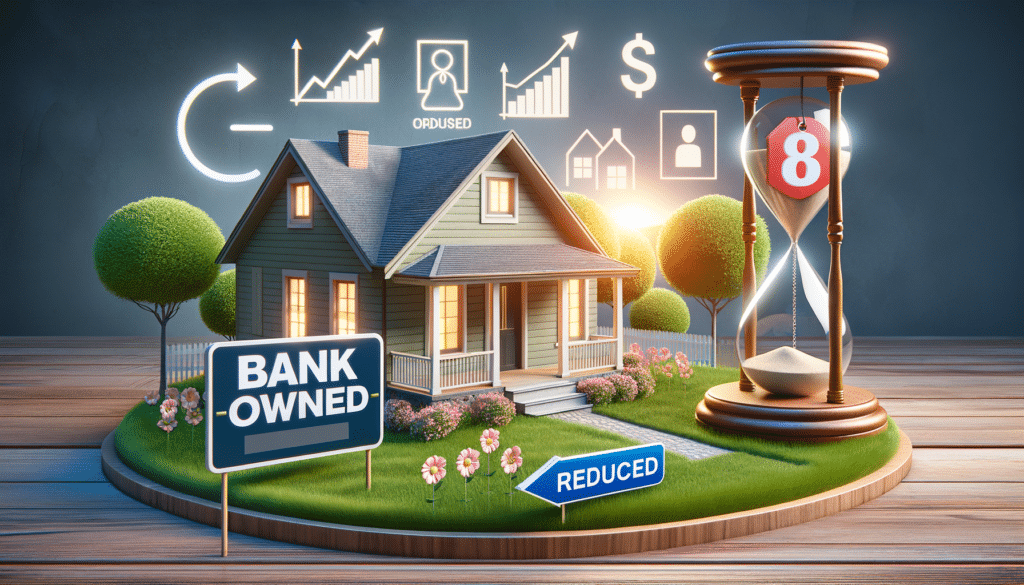

How to Buy a Bank-Owned Home

Purchasing a bank-owned home, often referred to as a real estate owned (REO) property, can be a unique opportunity for homebuyers and investors alike. The process, however, differs from buying a traditional home. To start, it’s crucial to understand that these homes have been foreclosed and are now owned by the bank. This means the bank is eager to sell and recover its losses, which can work in your favor. Begin by securing financing, as having a pre-approval letter can strengthen your offer. Next, work with a real estate agent experienced in REO transactions. They can guide you through the process and help identify properties that suit your needs.

Once you’ve identified a property, conduct a thorough inspection. Bank-owned homes are typically sold “as-is,” meaning the bank will not make any repairs. It’s essential to assess the condition of the home to avoid unexpected expenses. After inspection, you can submit an offer. It’s common for banks to counteroffer, so be prepared to negotiate. Understanding the market value and comparable sales in the area can provide leverage during negotiations. Finally, ensure you have the necessary funds to cover closing costs and any immediate repairs or renovations.

Why Bank-Owned Homes Are Cheaper

Bank-owned homes are often priced lower than market value for several reasons. Firstly, banks are not in the business of holding real estate; they aim to sell these properties quickly to recoup their losses from the foreclosure process. This urgency often translates into lower prices. Additionally, bank-owned homes might have been vacant for some time, potentially leading to maintenance issues that deter some buyers. As a result, these homes may be listed at a discount to attract interest.

Another factor contributing to the lower price is the “as-is” condition of these homes. Banks typically do not invest in repairs or upgrades before selling, leaving any necessary work to the buyer. This can be a deterrent for some, but for others, it presents an opportunity to purchase a property at a reduced price and add value through renovations. Furthermore, banks often have multiple foreclosed properties on their books, creating a supply that exceeds demand, which can drive prices down. For savvy buyers, this scenario can lead to acquiring a property below market value.

Can You Negotiate with a Bank for Bank-Owned Homes?

Negotiating the purchase of a bank-owned home is not only possible but also expected. Unlike traditional sellers, banks are motivated to sell quickly, which can give buyers an advantage in negotiations. However, it’s crucial to approach the process strategically. Start by researching the property’s history and understanding its market value. This information will help you make a competitive offer.

When negotiating, be prepared for a counteroffer from the bank. They may have a bottom line price they are unwilling to go below, but knowing the property’s value and having a clear budget can help you navigate these discussions. Additionally, banks may be more willing to negotiate on closing costs or offer other incentives, such as a home warranty, to facilitate the sale.

It’s also beneficial to have a real estate agent who is experienced in REO transactions. They can provide insights into the bank’s priorities and help you craft a compelling offer. While negotiating, keep in mind that the bank’s primary goal is to sell the property quickly, so demonstrating your ability to close the deal efficiently can be advantageous.